The most asked question that the Tried & True Team faces is “What is Your Rate”. We recognize that this question is incredibly important to your company’s bottom line.

It is important to understand that there have been a lot of changes in the industry that has an impact on the cost of accepting payments. There are rules associated with what method of pricing you select. It is important that you follow the rules and ensure that your merchant representative understands the implications for following the rules.

The fines associated with violating the policy can run into the thousands to tens of thousands of dollars. When you select the proper pricing methodology you, ensure proper communication between the cardholder and your company and required signage is implemented and you will optimize your bottom line.

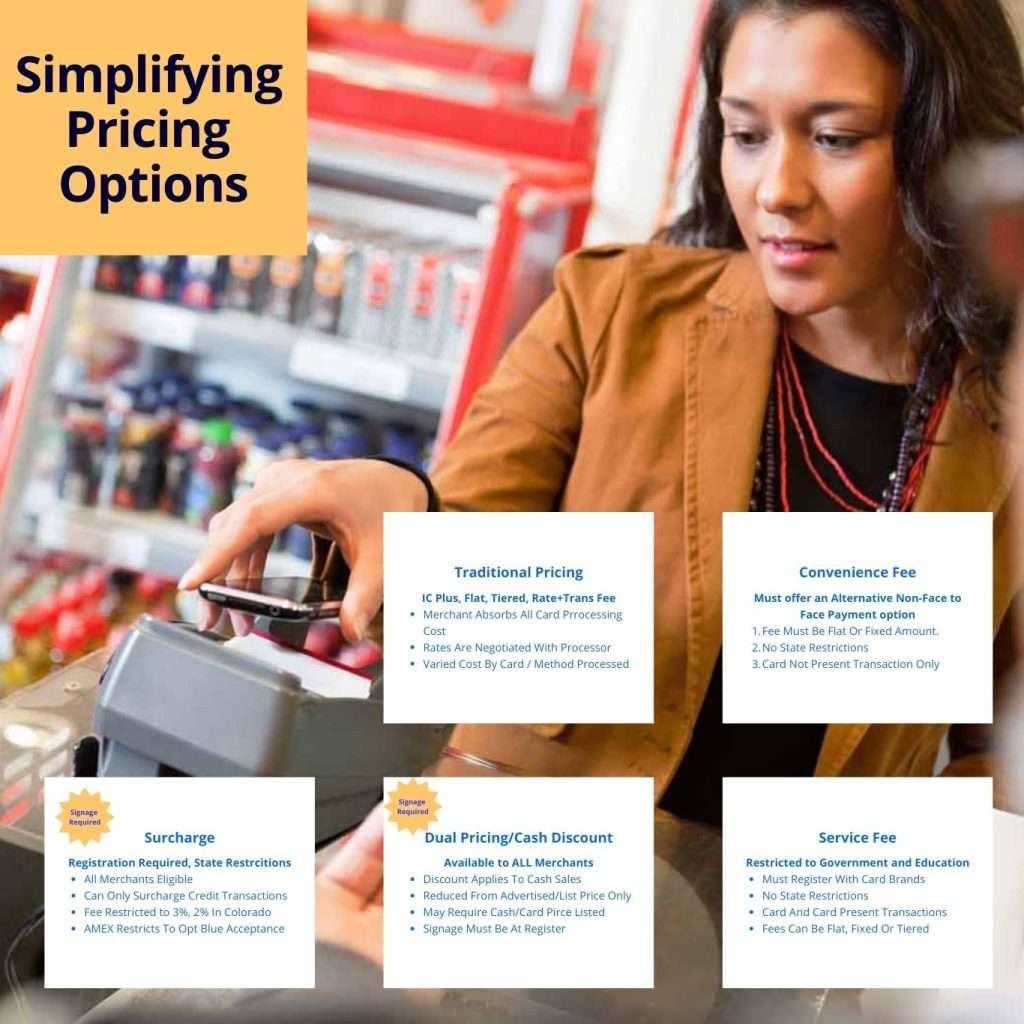

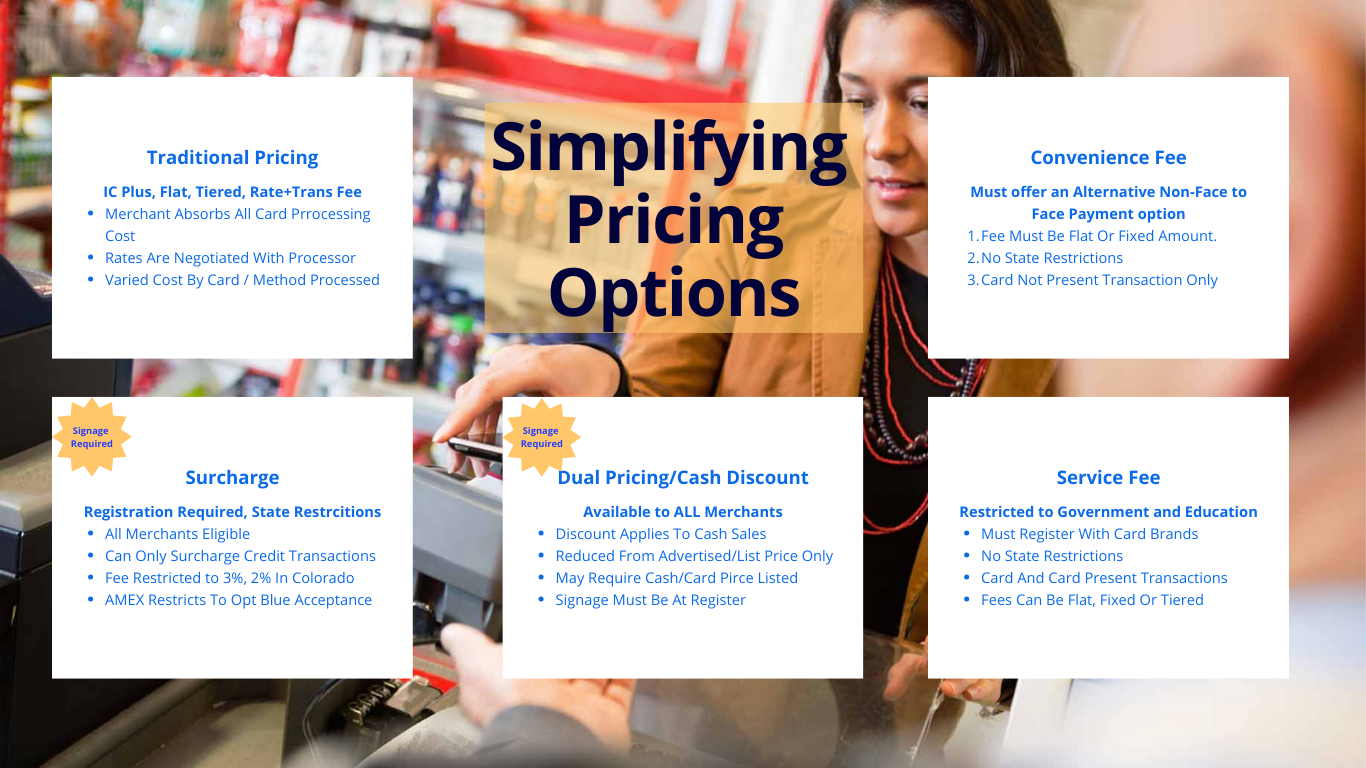

To help you better understand what is available today here is the information you should consider.

- Incurring the cost of accepting payments as part of their business expense. What we like to call traditional merchant pricing. This can come in several different forms.

- Flat Rate (one rate for all transactions)

- Tiered Rate (swipe, non-swipe, or qualified/mid-qualified/non-qualified)

- Cost Plus Pricing, Interchange Plus, one of the most transparent forms of processing credit cards.

- Deferring some of the cost of accepting cards through a surcharge program. There are definitive rules associated with this form of card acceptance as outlined in this article.

- Setting a fee for accepting all forms of payments through a Convenience Fee. This form of payment does require that a fee apply to ALL payment methods (Cash, Card, ACH, Check).

- One of the fastest growing methods of accepting cards is Dual Pricing whereby the business owner increases the price to include what would be the equivalent of the cost of accepting cards. When properly implementing this strategy, you can eliminate the cost of accepting cards and essentially pay a small monthly fee.

- For a select fee industries a Service Fee program can be implemented. There are strict guidelines and merchant classification codes that are eligible to charge a service fee so please read that section carefully and do not implement this strategy if your business is not in the proper classification code.

Here are a few tips to help you avoid the shoppers and potential fines.

- DO NOT have a line item that adds a fee on a receipt for processing. This is a non-compliant surcharge and could be subject to a fine. Often, this is labeled non-cash adjustments. Instead, increase your price and offer a cash discount on the transaction for those presenting debit cards, cash and check, or use a Surcharge program where only a CREDIT CARD is assessed a maximum fee of 3.00% (be sure to check if you are in a state where this is capped or prohibited).

- If you are processing transactions online, be sure you avoid the trap of using language like technology fee, service fee (remember only certain mcc codes permit this form of fee), or anything that may apply to all cards but not ACH. This is a surcharge and is subject to fines. Instead, use a true surcharge program whereby only the credit card is assessed a fee, while the ACH or Debit card payment is not assessed the fee.

- Be sure that whatever method of pricing you select know the rules, or ask your merchant provider to share the rules for disclosure on labels on retail shelves, menu signage, etc, and proper storefront, register or menu prices are properly reflecting the price differential where required.

- Don’t assume that there are no rules, check the state rules and at all times comply with the Card Brand rules. Visa has done an exceptional job of providing resources and educational material (it may be confusing, and your payments partner should be an expert).

Enjoy the additional content and we thank Rob Johnson from Visa for the excellent summary and links for your review. As always, call Tried & True for the most up to date technology, signage and payments advice in the industry. We are proud to serve you!

SURCHARGE

- Applied to credit cards only

- Cannot exceed 3% or cost of acceptance (whichever is lower)

- Must be included in the total transaction amount

- 30 day wait after informing the acquirer of intent

- Must be disclosed in Field 28, on receipt and POS & POE signage

- Not Legal in all US States. Prohibited in:

- Connecticut

- Maine

- Massachusetts

- Oklahoma

- New York*

- Other State regulations now in place with more coming

- Colorado capped at 2%

*Bold and Underline represent the reasons that most companies get fined.

SERVICE FEE

- Can be applied to all card types

- Only applied by US Merchants in the Government & Education sector

- 8211 (Elementary and Secondary Schools)

- 8220 (Colleges, Universities, Professional Schools, and Junior Colleges)

- 8244 (Business and Secretarial Schools)

- 8249 (Vocational and Trade Schools)

- 9211 (Court Costs, Including Alimony and Child Support)

- 9222 (Fines)

- 9311 (Tax Payments)

- 9399 (Government Services [Not Elsewhere Classified])

- Can be a fixed amount or a Percentage

- Must register merchant with Visa first

- Can be included or a separate transaction

- No limit on amount of fee

- No transaction data requirements

- No State restrictions

CONVENIENCE FEE

- Must be applied equally to all accepted payment methods

- Must be a fixed amount – cannot be a percentage

- Merchant must support a convenience fee-free channel for card payments

- Cannot be assessed by a merchant operating only in the card-absent environment

- Must be included in the total transaction amount

- Cannot be assessed by 3rd party

- No transaction data requirements

- No registration requirements

- Legal in all US States (For NY, if clearly disclosed in pricing up front)

DUAL PRICING

- The increase in price must be included in the total price of the items being purchased.

- Merchant must place appropriate signage at the register or on the menu in the states where applicable.

- The following states require that signage be placed side by side on the menu or shelf price as well as the front door:

- Connecticut

- Maine

- Massachusetts

- Oklahoma

- New York

- The following states require that signage be placed side by side on the menu or shelf price as well as the front door:

- Providing a discount for cash and ACH is permissible under Dual Pricing.

- Cannot apply dual pricing to card not present transactions.

- No additional fee may be charged above the amount listed on the menu/shelf, nor may you apply a fee at the point of sale and on the card receipt.

VISA RULES

- Visa Rules: https://usa.visa.com/content/dam/VCOM/download/about-visa/visa-rules-public.pdf

- Surcharge guidance https://usa.visa.com/support/small-business/regulations-fees.html

- Other questions: Visarulesinquiries@visa.com