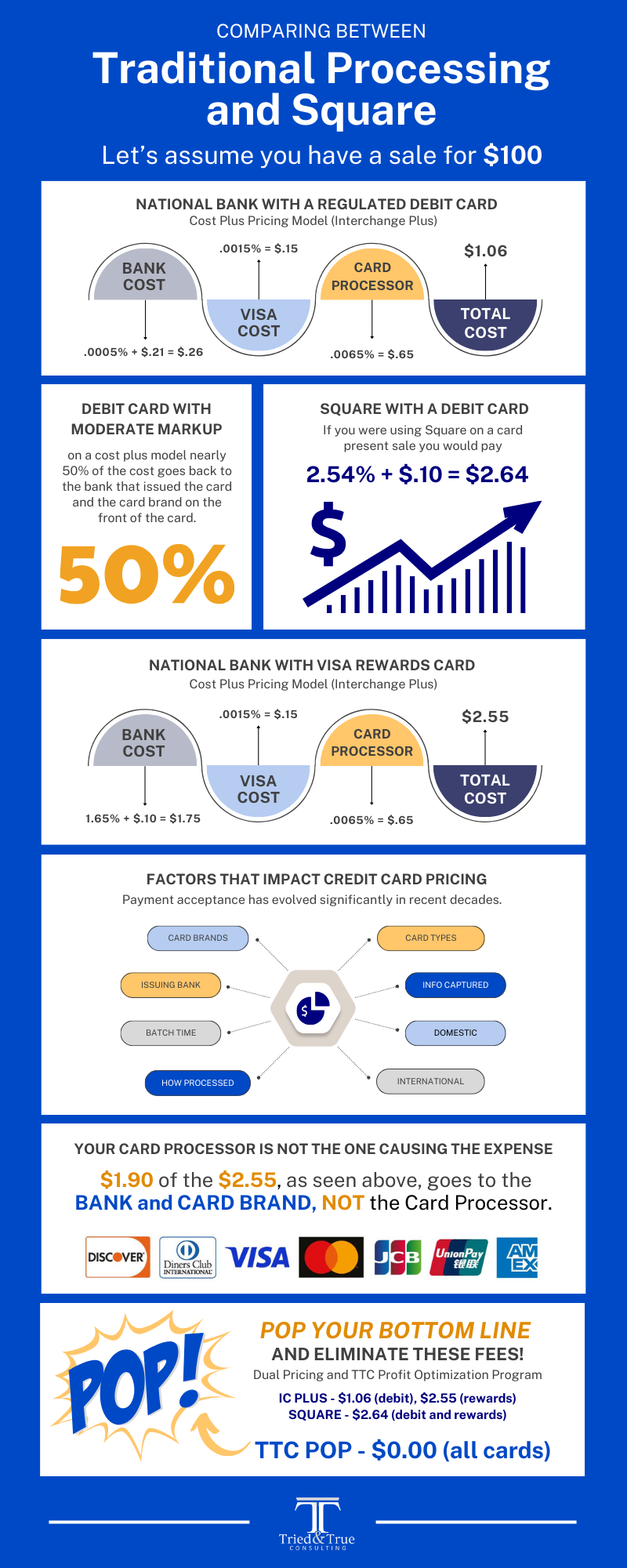

Accepting Payments has changed a lot over the last several decades. What started out as a couple of rates for card present and card not present has rapidly changed to reflect a complex pricing discussion based on many variables that make it very difficult for you the business owner to comprehend.

Factors that impact credit card pricing:

-

- CARD BRANDS – Visa, MasterCard, American Express, Discover, JCB, Diners

-

- CARD TYPES – Debit, Credit, Rewards, Signature Cards, World T&E, Business Cards, Commercial Cards, Purchase Cards to name a few

-

- THE BANK THAT ISSUES THE CARD – National Bank, Community, Credit Union

-

- WHERE THE CARD IS FROM – Domestic, International

-

- HOW YOU PROCESS THE CARD – Dip, Swipe, Tap, Keyed, Ecommerce, Phone-Order Recurring

Companies have come out with simplified pricing strategies that really are simple in design but rich in profit for the company pricing your transaction. We all respect Square, Stripe and other integrated payment companies, but understand that what you see as simple does lead to higher transaction cost of doing business.

The banks that issue the card set rates for the cards they issue. The card brands set a price for the privilege of accepting their logo. Credit card processors set prices for the risk, servicing and handling of the transaction and of course the credit card processing company sets prices.

Here is a simple illustration to help you understand where all the money goes based on the rate structure by the card brand. You might be surprised who is really making the money!

Let’s assume a $100.00 sale and the first example is a (regulated debit card – National Bank)

If Cost Plus Pricing (some call it interchange plus)

-

- Cost for the BANK to approve the transaction – .0005% + $.21 = $.26

-

- Cost for the VISA Brand (sponsor everything) – .0015% = $.15

-

- Cost for the CARD PROCESSOR (moderate mark up) – .0065% = $.65

-

- Total Cost = $1.06

On a debit card with a moderate mark-up on a cost plus model nearly 50% of the cost goes back to the bank that issued the card and the card brand on the front of the card.

If you were using Square on a card present sale you would pay 2.54% + $.10 = $2.64 (they really get you on debit cards)

What if the card were a standard Visa Traditional Rewards Credit Card?

-

- Cost for the BANK – 1.65% + $.10 = $1.75

-

- Cost for VISA Brand – .0015% = $.15

-

- Cost for Card PROCESSOR – .0065% = $.65

-

- Total Cost – $2.55

Outside of debit cards, the BANK and CARD BRAND really get the majority of the money on every dollar collected to accept a credit card. In this case $1.90 of the $2.55 goes to the BANK and CARD BRAND. Your card processor is really not the one causing the expense.

At Tried & True Consulting we will review your current needs, if you are accepting cards determine who is buying from you, what cards they use, look for ways to reduce expense and risk and then determine which pricing method will work best for you.

Pricing Strategies Used by Payment Processing Companies

-

- Flat-rate pricing:

-

- In this model, merchants are charged a fixed percentage of each transaction along with a small per-transaction fee. This pricing strategy is simple and easy to understand, making it popular among small businesses. Square, for example, offers a flat-rate pricing structure.

-

- Flat-rate pricing:

-

- Interchange-plus pricing:

-

- This pricing model passes the interchange fees (fees set by card networks like Visa and Mastercard) directly to the merchant, along with a fixed markup fee. It provides transparency and can be cost-effective for businesses with a high volume of credit card transactions.

-

- Interchange-plus pricing:

-

- Tiered pricing:

-

- In tiered pricing, transactions are grouped into different tiers or categories based on factors like card type, transaction method (swiped, keyed, online), and risk level. Each tier has a different rate, and the merchant is charged accordingly. This pricing strategy can be less transparent and may result in higher costs for businesses, as it’s often more challenging to predict the rates.

-

- Tiered pricing:

-

- Flat monthly fee:

-

- Some merchant services providers offer a flat monthly fee for unlimited transactions within certain limits. This pricing model can be advantageous for businesses with high transaction volumes, as it provides predictability in monthly expenses.

-

- Flat monthly fee:

-

- Cost-plus pricing (wholesale pricing):

-

- This pricing model involves passing the actual interchange and assessment fees to the merchant, along with a fixed markup. While it provides transparency, it may require more effort to understand and calculate costs.

-

- Cost-plus pricing (wholesale pricing):

-

- Dual-Pricing (Reverse Your Fees):

-

- This pricing model involves providing the consumer with a choice at the point of sale to pay by cash or card. All prices at the location must be listed as the card price (higher of the two), in some states it is required that you have both prices listed on the display boards/shelf bar code sticker/menu. The customer then has the option at the point of sale to choose between paying a lower price with cash and the listed price for card. Think of a gas station listing both prices.

-

- Dual-Pricing (Reverse Your Fees):

-

- Surcharge (Pass the Fee Onto Cardholder):

-

- This pricing model involves passing the actual cost of credit card processing (excluding debit cards) to the cardholder. The fee should only cover the cost of the fees for credit card acceptance. There are a number of regulatory (federal/state) and card brand rules that must be observed when implementing this pricing strategy. Transparency to the consumer is absolutely required (signage at the door, register, receipt and in some states on the shelf stickers).

-

- Surcharge (Pass the Fee Onto Cardholder):

With the Tried & True POP Program, you eliminate these fees! We bring your transaction fees to ZERO.

Book your FREE consultation now by clicking the button below to see a how we can make real impact to your business while making your bottom line POP!

Clark Howard’s Opinion on the Benefits of Dual Pricing

**Equipment Management Solution (EMS) is owned and operated by Tried & True. EMS was created to handle all equipment sourcing and billing for point of sale technology and solutions. Tried & True will invoice and debit our merchants when purchasing hardware and services through the EMS brand.